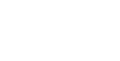

Metal Coin Bank with Secure Lock for Safe Saving and Storage

The Metal Money Box with Lock A Safe Haven for Your Savings

In an age dominated by digital transactions and virtual currencies, the charm of a traditional money box remains timeless. The metal money box with a lock stands out as a simple yet effective tool for personal finance management. This quintessential household item not only serves a practical purpose but also embodies nostalgia, teaching values of saving and security from a young age.

The Design and Features

At first glance, a metal money box with a lock appears to be an unassuming object. Typically crafted from durable materials like steel or tin, these boxes come in various sizes and designs, making them both functional and aesthetically pleasing. Many feature vibrant colors, charming patterns, or even themed decorations catering to children and adults alike. The most distinctive aspect is the secure locking mechanism, which ensures that your savings are not accessible to prying hands.

The design of these money boxes is intentional. Large enough to hold considerable amounts of cash, yet compact enough to fit on a shelf or a bedside table, they are perfect for individuals looking to save without the hassle. The lock serves a dual purpose protecting your funds from theft and encouraging deliberate saving habits. In a world where instant gratification is common, having a locked money box makes saving an intentional act, requiring effort and commitment.

The Psychological Benefits of Saving

The act of saving money can be seen as a powerful psychological tool. Research indicates that physically seeing money accumulate can foster a sense of accomplishment and financial discipline. A metal money box with a lock allows individuals to experience this firsthand. The joy of hearing coins clink against each other, or the satisfaction of feeling the weight of bills as they stack up, reinforces positive financial behaviors.

metal money box with lock

Furthermore, having a dedicated place to store your savings instills a sense of security. The locked box serves as a tangible reminder of your financial goals, encouraging individuals to prioritize saving over unnecessary spending. For children, it becomes an early lesson in money management, teaching them to distinguish between wants and needs while building a foundation of financial literacy.

Practical Uses in Everyday Life

These money boxes fulfill various practical purposes in everyday life. For some, they are a tool for saving for a specific goal, like a vacation, a new gadget, or a special event. Setting aside money in a locked box can make it easier to resist the temptation to spend impulsively. By having a clear target connected to their savings, individuals often find greater motivation to contribute regularly.

Moreover, these boxes can also serve as a unique gift idea. Whether for a birthday, graduation, or a significant life event, gifting a personalized metal money box can encourage the recipient to start their saving journey. Adding a lock makes it even more special, symbolizing not just security but also trust in the individual’s ability to manage their finances responsibly.

A Modern Relevance

Despite the rise of digital banking and cryptocurrency, the relevance of a metal money box with a lock has not diminished. In fact, it has found renewed appreciation in a world that often feels uncertain and volatile. People are increasingly looking for ways to take control of their financial futures. The tangible nature of cash savings can serve as a comforting counterbalance to digital assets that can feel abstract and elusive.

In conclusion, a metal money box with a lock is more than just a simple storage solution; it is a symbol of security, discipline, and tradition. In this fast-paced world, it encourages us to slow down, think about our spending habits, and focus on building a secure financial future. Whether used by children learning the value of money or adults diligently saving for a dream, this humble yet significant item continues to play an essential role in personal finance across generations. The metal money box remains a steadfast companion on the journey to financial wellness, signifying that saving is not merely a goal; it is a lifestyle.

-

Wrought Iron Components: Timeless Elegance and Structural StrengthNewsJul.28,2025

-

Window Hardware Essentials: Rollers, Handles, and Locking SolutionsNewsJul.28,2025

-

Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff CuttersNewsJul.28,2025

-

Sliding Rollers: Smooth, Silent, and Built to LastNewsJul.28,2025

-

Cast Iron Stoves: Timeless Heating with Modern EfficiencyNewsJul.28,2025

-

Cast Iron Pipe and Fitting: Durable, Fire-Resistant Solutions for Plumbing and DrainageNewsJul.28,2025

-

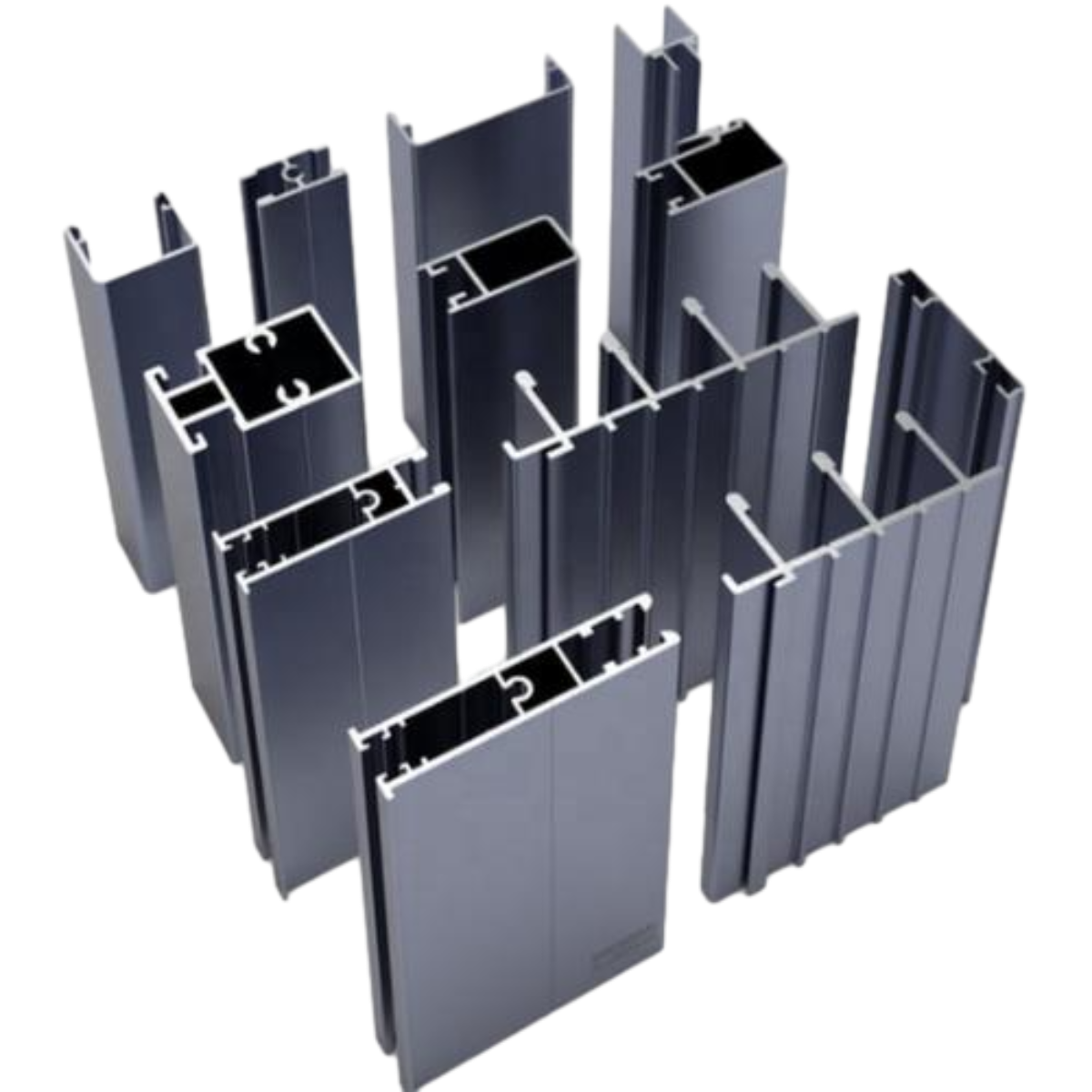

Wrought Iron Components: Timeless Elegance and Structural StrengthJul-28-2025Wrought Iron Components: Timeless Elegance and Structural Strength

Wrought Iron Components: Timeless Elegance and Structural StrengthJul-28-2025Wrought Iron Components: Timeless Elegance and Structural Strength -

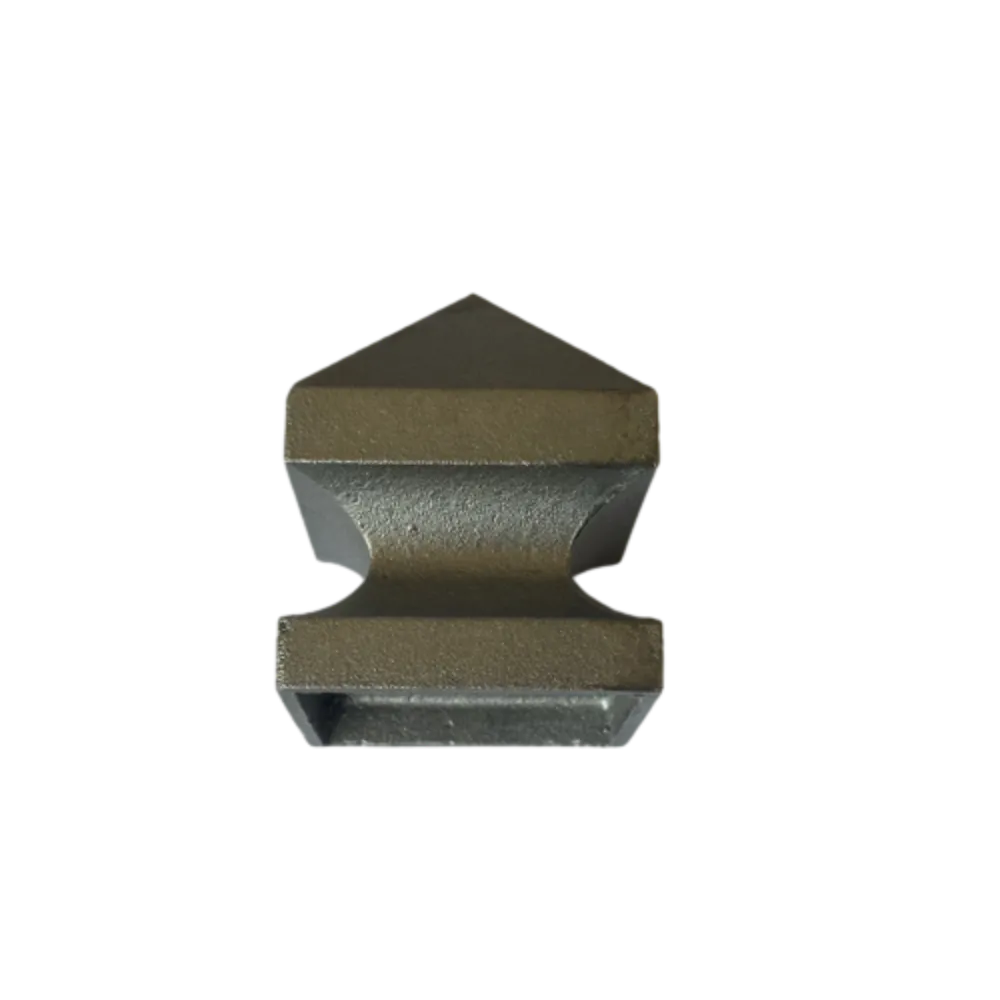

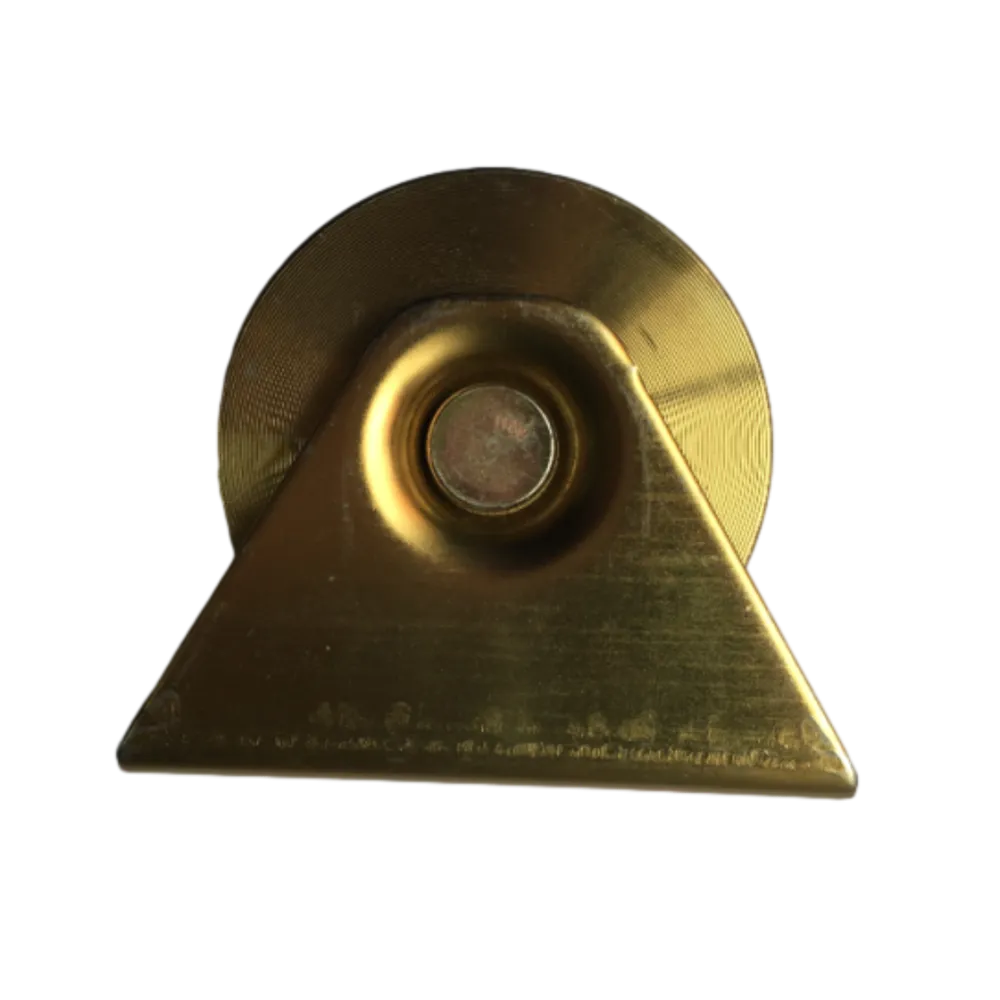

Window Hardware Essentials: Rollers, Handles, and Locking SolutionsJul-28-2025Window Hardware Essentials: Rollers, Handles, and Locking Solutions

Window Hardware Essentials: Rollers, Handles, and Locking SolutionsJul-28-2025Window Hardware Essentials: Rollers, Handles, and Locking Solutions -

Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff CuttersJul-28-2025Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff Cutters

Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff CuttersJul-28-2025Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff Cutters