Steel Cash Box for Secure and Convenient Small Transactions

The Importance of a Steel Petty Cash Box in Financial Management

In the realm of financial management, the need for effective handling of small transactions is paramount. One of the essential tools that businesses often rely on is the petty cash box. Among the various types available, a steel petty cash box stands out for its durability, security, and practicality. This article will delve into the significance of a steel petty cash box and how it can streamline financial processes within an organization.

What is a Petty Cash Box?

A petty cash box is a small, secure container used to store cash for minor expenses that arise in day-to-day operations. These expenses may include office supplies, transportation costs, or employee reimbursements. Instead of going through the lengthy process of issuing checks or making bank transfers for minor purchases, businesses utilize petty cash to enhance efficiency. However, managing petty cash requires discipline and accountability to prevent misuse or loss.

Why Choose a Steel Petty Cash Box?

1. Durability and Security Steel petty cash boxes are crafted from robust materials, making them resistant to wear and tear. Unlike plastic alternatives, a steel box offers increased security against theft and tampering. Many options come equipped with locks that provide added protection for the cash inside. This is particularly essential for businesses that handle larger amounts of petty cash or operate in environments where theft is a concern.

2. Organizational Benefits A steel petty cash box enables better organization of financial records. By compartmentalizing cash, businesses can track expenditure efficiently. The box allows for easy categorization of receipts and expenses, making it straightforward to maintain accurate financial records. When it comes time for reconciliation, having organized cash and receipts simplifies the process and minimizes errors.

3. Accountability and Transparency Implementing a petty cash system fosters accountability among staff. Each transaction must be documented, detailing the date, amount, and purpose. This practice not only discourages misuse but also promotes transparency within the organization. With a steel petty cash box, businesses can systematically monitor who accessed the funds and for what purpose, enhancing overall financial control.

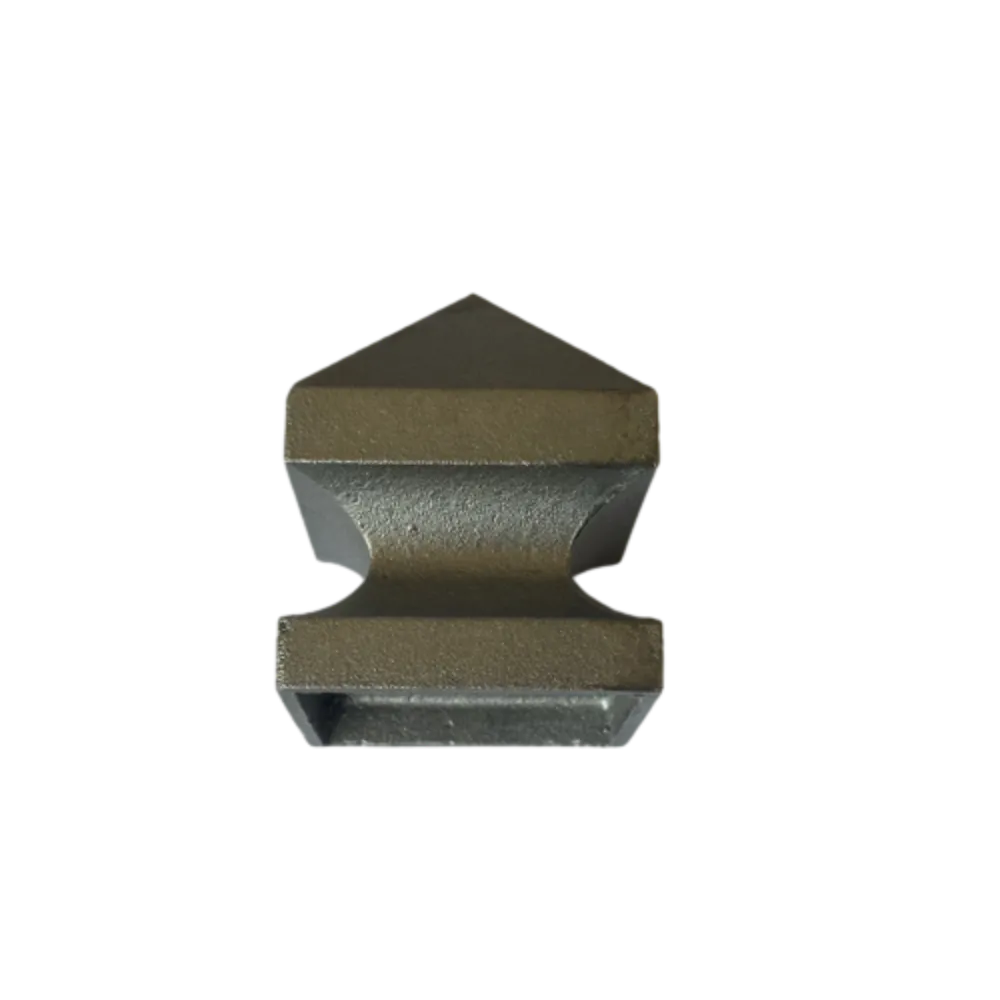

steel petty cash box

How to Implement a Petty Cash System?

To effectively implement a petty cash system, the following steps can be adopted

1. Set a Budget Determine the amount of petty cash that will be allocated, considering the typical expenses incurred within a specific timeframe.

2. Designate a Custodian Assign a responsible individual as the petty cash custodian. Their role will include managing the funds, approving withdrawals, and ensuring all transactions are documented.

3. Maintain Records Keep a detailed log of all petty cash transactions. This log should include the amount taken, the purpose of the expense, and a corresponding receipt.

4. Regular Reconciliation Schedule regular intervals for reconciling the petty cash box. This involves checking the cash remaining against the transaction records to ensure everything aligns.

Conclusion

A steel petty cash box serves multiple roles in a business beyond just being a container for cash. It enhances security, promotes organization, and fosters accountability, all of which are vital components of sound financial management. Whether in a small startup or a larger corporation, adopting a petty cash system using a steel box can lead to streamlined operations and better control over funds. In a world where every dollar counts, investing in effective petty cash management is a step towards greater financial integrity and operational efficiency.

-

Wrought Iron Components: Timeless Elegance and Structural StrengthNewsJul.28,2025

-

Window Hardware Essentials: Rollers, Handles, and Locking SolutionsNewsJul.28,2025

-

Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff CuttersNewsJul.28,2025

-

Sliding Rollers: Smooth, Silent, and Built to LastNewsJul.28,2025

-

Cast Iron Stoves: Timeless Heating with Modern EfficiencyNewsJul.28,2025

-

Cast Iron Pipe and Fitting: Durable, Fire-Resistant Solutions for Plumbing and DrainageNewsJul.28,2025

-

Wrought Iron Components: Timeless Elegance and Structural StrengthJul-28-2025Wrought Iron Components: Timeless Elegance and Structural Strength

Wrought Iron Components: Timeless Elegance and Structural StrengthJul-28-2025Wrought Iron Components: Timeless Elegance and Structural Strength -

Window Hardware Essentials: Rollers, Handles, and Locking SolutionsJul-28-2025Window Hardware Essentials: Rollers, Handles, and Locking Solutions

Window Hardware Essentials: Rollers, Handles, and Locking SolutionsJul-28-2025Window Hardware Essentials: Rollers, Handles, and Locking Solutions -

Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff CuttersJul-28-2025Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff Cutters

Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff CuttersJul-28-2025Small Agricultural Processing Machines: Corn Threshers, Cassava Chippers, Grain Peelers & Chaff Cutters